Q1: What is a Tobacco License?

A1: A Tobacco License is a permit or authorization issued by the government or regulatory authority in India that allows individuals or businesses to engage in the manufacturing, distribution, or sale of tobacco products. It is a legal requirement to ensure compliance with regulations governing the tobacco industry.

Q2: Why do I need a Tobacco License?

A2: A Tobacco License is necessary to legally manufacture, distribute, or sell tobacco products in India. It ensures that individuals or businesses involved in the tobacco industry comply with the laws and regulations pertaining to the production, packaging, labeling, storage, and sale of tobacco products.

Q3: What types of tobacco products require a Tobacco License?

A3: The Tobacco License is required for the manufacturing, distribution, or sale of various tobacco products, including cigarettes, cigars, bidis, chewing tobacco, snuff, gutka, or any other tobacco-based products specified by the Tobacco Board.

Q4: How can I obtain a Tobacco License?

A4: The process for obtaining a Tobacco License may vary depending on the state or local jurisdiction in India. Generally, it involves submitting an application along with the required documents, fees, and information about the intended activities. The application is reviewed by the Tobacco Board, and if found satisfactory, the license is granted.

Q5: What are the eligibility criteria for obtaining a Tobacco License?

A5: The specific eligibility criteria for obtaining a Tobacco License may vary based on the regulations set by the concerned authority. Generally, individuals or businesses seeking a Tobacco License must comply with specific requirements related to premises, storage facilities, health and safety measures, taxation, and compliance with tobacco control laws.

Q6: Can I sell tobacco products without a Tobacco License?

A6: No, it is illegal to sell tobacco products without a valid Tobacco License in India. Selling tobacco products without a license can lead to legal consequences, penalties, or closure of the business. It is important to comply with the regulations and obtain the necessary license before engaging in the sale of tobacco products.

Q7: What are the responsibilities of a Tobacco License holder?

A7: The responsibilities of a Tobacco License holder typically include:

-

- Complying with all applicable laws, regulations, and guidelines related to the manufacturing, distribution, or sale of tobacco products.

- Adhering to packaging and labeling requirements, including health warnings and graphic images as mandated by the regulatory authority.

- Maintaining accurate records of production, sales, and inventory of tobacco products.

- Ensuring compliance with taxation and reporting requirements related to tobacco products.

- Implementing measures to prevent the sale of tobacco products to minors or in prohibited areas.

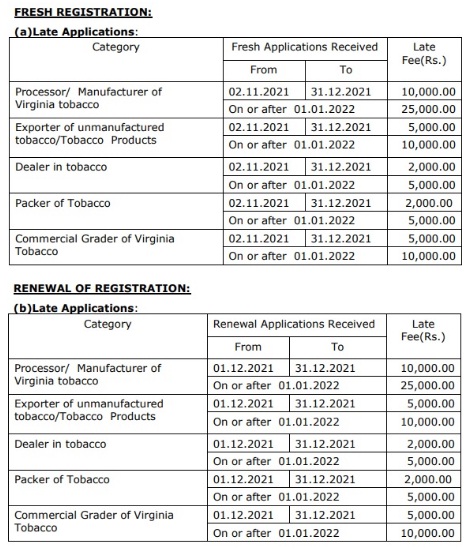

Q8: Are there any ongoing requirements or renewals for a Tobacco License?

A8: Yes, most Tobacco Licenses require periodic renewal. The specific renewal process and requirements may vary depending on the jurisdiction and regulatory authority. It is important to comply with the renewal requirements to maintain a valid and active license.

It is advisable to consult Tobacco Board for accurate and up-to-date information regarding Tobacco License requirements in your specific area.

Get License shares complete details on Tobacco Export License Registration, Types, Validity, Eligibility, Documents, Guidelines, Fee, Registration Process and where to Apply. It is a step by step guide which you can use to Register for Tobacco Export License on your own via Tobacco Board. Click on video to play..

Tobacco Export License Registration

To Register with Tobacco Board as Manufacturer / Processor / Exporter of Tobacco / Exporter of Tobacco Products / Packer / Dealer and Commercial Grader for any calendar year, please submit the applications through online (www.tobaccoboard.in) introduced by the Tobacco Board, as filing of applications through online is compulsory from 2016 calendar year onwards.

Contact Tobacco Board Guntur

-

- Address: Nr Medical CLub, Grand Trunk Rd, Nagarampalem, Guntur, Andhra Pradesh 522004

- Phone: 0863 235 8399

- Website: https://tobaccoboard.com

Do not Hire Consultants!

-

- Beware of so called Tobacco License Consultants who charge money to file tobacco export license applications.

- Do not pay money to such people.

- They do not represent Tobacco Board.

- For Tobacco License you should always contact Tobacco Board Directly.

Related Topics

Types of Tobacco Export License Registration

Tobacco Export License Validity

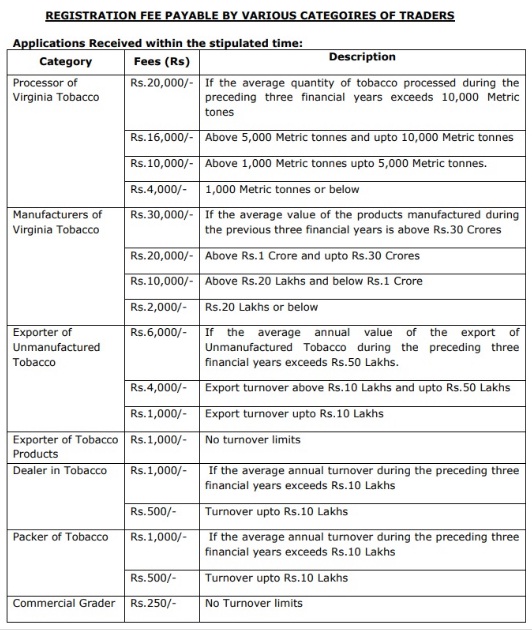

Tobacco Export License Registration Fee

Documents Required for Tobacco Export License